Dutch Star Companies TWO

Dutch Star Companies TWO B.V. was listed on Euronext Amsterdam as of 19 November 2020 and successfully merged into a business combination with Cabka on 1 March 2022, changing the listed entity to Cabka N.V. (ticker-symbol: “Cabka”). Thus, realizing a second successful Dutch Star Companies listing on the Amsterdam stock exchange.

Cabka N.V.

Cabka founder and vice-chairman Gat Ramon and his wife Heike open the Euronext Amsterdam stock exchange on 1 March 2022 on the occasion of the formal business combination of DSC2 and Cabka and further listing of Cabka

DSC2 €110m listing in 2022

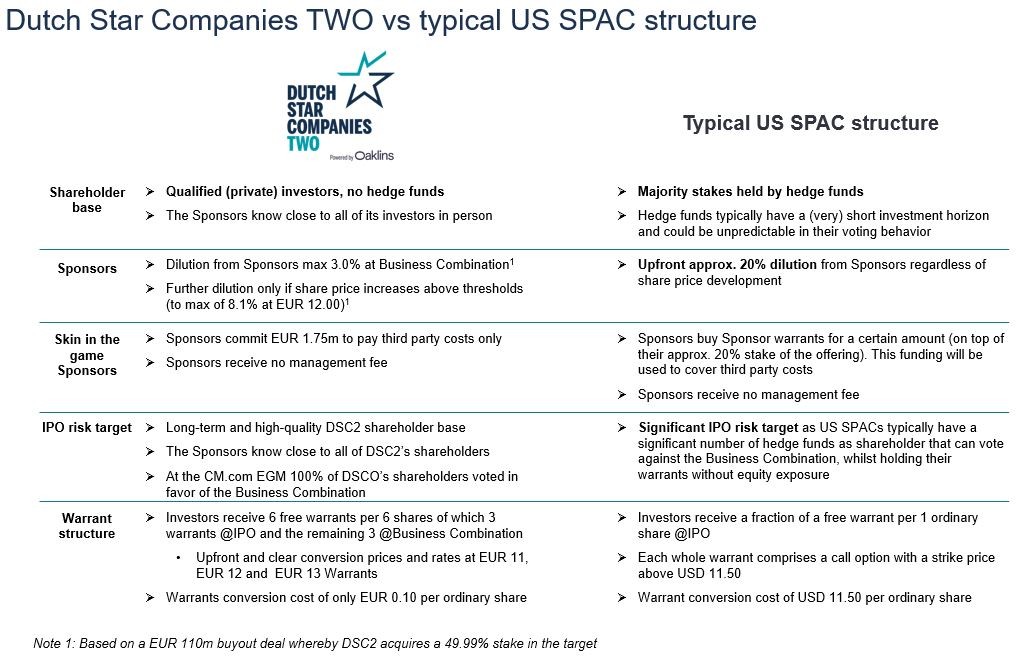

Dutch Star Companies TWO raised €110 million in equity in its 19 November 2020 IPO. Of this equity 99% was deposited in an escrow account to invest in a significant minority stake of one target company active in Europe and preferably also the Netherlands within 2 years: the business combination.

Dutch Star Companies TWO and Cabka jointly announced exclusive discussions on a potential business combination on 23 December 2021, followed by the announcement of an agreement, subject to the approval of at least 70% of DSC1 shareholders, on 10 January 2022.

100% Support for business combination with Cabka

At an Extraordinary General Meeting of shareholders on 28 February 2022, 100% of DSCT shareholders voted in favor of the business combination with Cabka, resulting in a legal acquisition of Cabka GmbH by DSCT, immediately renaming Dutch Star Company TWO into Cabka N.V. to continue the activities of Cabka under that name. Shareholders of Dutch Star Companies TWO became shareholders of Cabka.

SPAC structure including ordinary shares and warrants delivered attractive returns for shareholders

For every six shares Dutch Star Companies TWO, listed ad €10 per share, shareholders received three warrants (DSCW1, DSCW2 and DSCW3) at the IPO on 19 November 2020 and three warrants (DSCW1, DSCW2 and DSCW3) following completion of the business combination on 4 March 2022.Under the terms as described in the prospectus the DSCW1 warrants were automatically converted into 0.12 ordinary shares Cabka N.V. per warrant.

Dutch Star Companies TWO: Offering Highlights

- The Offering consisted 1,833,334 Units each consisting of six Ordinary Shares and six Warrants, at a price per Unit of € 60.00 representing a total value of the Offering €110,000,040 The Ordinary Shares and three Warrant per Unit were issued at the Settlement Date of the listing and the other three Warrants per Unit shall be issued shortly after completion of the Business Combination.

- The Prospectus for the Offering of DSC2 has been approved by and filed with the Netherlands Authority for the Financial Markets (Autoriteit Financiële Markten, AFM on 16 November 2020.

- DSC2’s main objective is to complete a Business Combination within 24-30 months after the date on which settlement occurs. The reason for the Offering is to raise capital to fund the consideration to be paid for the Business Combination. 99% of the proceeds of the Offering will be deposited in an escrow account to achieve a Business Combination. In the current environment the escrow account will be subject to negative interest.

- Up to 1% of the proceeds of the Offering can be used to cover expenses of the SPAC.

- The Executive Directors -including Oaklins- of DSC2 have committed up to € 1.75 million to cover expenses of the SPAC.

- From listing DSC2 has 24 months (plus a potential one-time extension period of 6 months to be approved by the Non-Executive Directors of DSC2) to propose a company for a Business Combination. The proposed Business Combination needs to be approved by the shareholders of DSC2. If over 30% of the shareholders participating in the EGM do not approve the Business Combination, the team will start a new search. In case of a 70% or more approval for the Business Combination, shareholders not approving that Business Combination will be reimbursed. If a Business Combination is not announced to the shareholders of DSC2 ultimately within 30 months from the IPO date, DSC2 is dissolved and liquidated. The liquidity available in the escrow account is used to reimburse the shareholders in such an event.

- At the IPO shareholders received 3 warrants per 6 ordinary shares

- One with strike price €11.00 and a fixed conversion rate of 0.12 shares per warrant

- One with strike price €12.00 and a fixed conversion rate of 0.24 shares per warrant

- One with strike price €13.00 and a fixed conversion rate of 0.36 shares per warrant

- At Business Combination shareholders will receive another 3 warrants per 6 ordinary shares;

- One with strike price €11.00 and a fixed conversion rate of 0.12 shares per warrant

- One with strike price €12.00 and a fixed conversion rate of 0.24 shares per warrant

- One with strike price €13.00 and a fixed conversion rate of 0.36 shares per warrant

- Warrants will be automatically and mandatorily converted after establishing the Business Combination if the closing price has reached the relevant threshold for 15 trading days out of a 30-day consecutive trading period (whereby such 15 trading days do not have to be consecutive). The warrants will expire five years after the Business Combination.

- Executive Directors have received 293,333 Special Shares at the IPO that can be converted into Ordinary Shares in the Business Combination once the Business Combination has been completed and certain conditions have been met.

- With effect of the Settlement Date the Company's issued share capital consist of 51,448,135 Ordinary Shares with a nominal value of €0.01. This includes 40,455,937 treasury shares that might be used in realizing the Business Combination or for Warrant and Special Share conversion. At listing this represented a total market capitalization for DSC2 of €110 million (exclusive of treasury shares).

- Executive directors are bound by a 6 months lock-up from the date of Business Combination. (In the business combination agreement of DSC2 with Cabka the executive directors agreed to a 365-day lock-up starting from closing on 1 March 2022. The lockups are subject to certain customary carve-outs.)

Dutch Star Companies TWO: Investment Highlights

Track record proves concept

- Dutch Star Companies launched its first SPAC, Dutch Star Companies ONE, in 2018. Shares and warrants of DSCO were listed in a €55 million IPO on Euronext Amsterdam as of 22 February 2018 at €10 per share. DSCO successfully merged into a Business Combination with CM.com on 21 February 2020.

- Dutch Star Companies’ promising concept and structure (originated by Oaklins) has by now matured into a proven concept for especially midsized companies with successful execution of Dutch Star Companies ONE and a clearly positively recognized Business Combination in the market.

- DSC2 is supported by the same Executive and Non-Executive Directors and support team as the first SPAC, bringing unparalleled experience with structuring, fundraising and execution of a SPAC in the Netherlands with proven ability to act swiftly and decisively.

- Continuing as Non-Executive Directors are Joop van Caldenborgh, Chairman; Pieter Maarten Feenstra; Aat Schouwenaar and Rob ten Heggeler.

High quality shareholder base

- Building on the strong relationships of Executive Directors and Oaklins, Dutch Star Companies has attracted a high quality and stble shareholder base of Dutch entrepreneurs, family offices, High-Net-Worth-Individuals and executives. This has proven to be an important asset in the transaction of the Business Combination’s shares. The number of shareholders in DSC2 is more than doubled compared to DSC1 with the addition of new good quality shareholders to a future Business Combination.

Access to potential targets

- Both the Executive Directors and the extensive Oaklins network are well connected and have access to many potential targets.

- DSC2 is a unique investment opportunity for shareholders to get access to a not yet listed company that might otherwise not be in reach.

Win-win-win structure works for all parties

- Shareholder DSC2 win: Access to new investment opportunities. Warrant structure gives attractive investor returns if the stock performs well.

- Target shareholders win: DSC2 can significantly shorten the time to IPO for the company and upon approval of DSC2 shareholders to receive a pre-agreed price for a minority of their company.

- SPAC team win: Incentives for reward are largely aligned with shareholders DSC2.

Important documents Dutch Star Companies TWO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|